Balancing Convenience and Security with Account Aggregator Systems

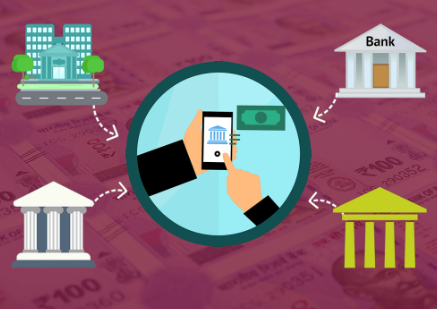

In the evolving landscape of financial services, the concept of an Account Aggregator System has emerged as a revolutionary tool. This system enables individuals to consolidate and manage their financial data from various institutions in one place. While this offers unparalleled convenience, it also raises important questions about security and data privacy. Let's explore how AA Systems strike a balance between these two critical aspects.

Convenience of Account Aggregator Systems

Centralised Financial Management

One-Stop Access: Users can view and manage all their financial accounts, including bank accounts, investments, and loans, through a single platform.

Time Efficiency: Reduces the time spent logging into multiple sites or apps to check financial status.

Informed Decision-Making: With comprehensive financial data at their fingertips, users can make more informed financial decisions.

Enhanced Financial Opportunities

Personalised Financial Products: Based on the aggregated data, users receive tailored recommendations for financial products like loans or investment opportunities.

Credit Assessment: It is easier for lenders to assess creditworthiness, leading to quicker loan approvals.

Security Measures in Account Aggregator Systems

Robust Data Protection

Encryption: All data transmitted and stored within the system is encrypted, ensuring it remains confidential and secure.

Regular Audits: Frequent security audits are conducted to identify and mitigate any potential vulnerabilities.

User-Centric Data Control

Consent-Based Sharing: Users have complete control over what financial information is shared and with whom.

Transparency: The system provides clear information on how data is used, ensuring users are always aware of their data's status.

Regulatory Compliance

Adherence to Standards: These systems are often subject to stringent regulatory standards to protect user data.

Data Breach Protocols: In case of any breach, there are protocols in place for quick response and mitigation.

Challenges and Future Directions

While the benefits of Account Aggregator Systems are clear, there are ongoing challenges to address, particularly in the realms of data privacy and security. As technological advancements continue, the tactics employed by cybercriminals also become more sophisticated. This necessitates a continuous process of updating and strengthening security measures. Looking ahead, the future of AA Systems is promising, with potential advancements including:

AI-Powered Analytics: To provide more sophisticated financial insights.

Blockchain Integration: For enhanced security and transparency.

Global Standards for Data Sharing: To facilitate international compatibility and security protocols.

Conclusion

Account Aggregator Systems offer a convenient and efficient way to manage financial data, but they must continuously evolve to ensure the highest levels of security and data privacy. By striking the right balance, these systems can transform the financial landscape, making it more accessible, secure, and user-friendly. As these systems develop, they will become an indispensable tool for both personal and business financial management.

Comments

Post a Comment